Best Education Loan Providers in India

7 min read

Top Education Loan Providers in India

Your Key to Academic Excellence: Explore our curated list of the best education loan providers in India, offering competitive rates, flexible repayment options, and excellent customer service to help you achieve your educational goals.

- State Bank of India (SBI):

As one of the largest public sector banks in India, the State Bank of India (SBI) offers a range of education loan products tailored to meet the diverse needs of students. With competitive interest rates, flexible repayment options, and simplified application procedures, the State Bank of India (SBI) stands out as a preferred choice for education financing. - HDFC Bank:

HDFC Bank is renowned for its comprehensive suite of financial products, including education loans. With attractive interest rates, quick loan processing, and personalized customer service, HDFC Bank provides students with the support they need to confidently pursue their academic aspirations. - Axis Bank:

Axis Bank offers education loans with competitive interest rates and flexible repayment options to suit the individual needs of students. Axis Bank ensures a hassle-free borrowing experience for aspiring learners with a streamlined application process and convenient loan disbursement mechanisms. - Punjab National Bank (PNB):

PNB is a trusted name in the banking sector, known for its reliable financial solutions. The bank’s education loan offerings come with favorable terms, including low-interest rates, no processing fees for certain categories, and generous repayment tenures, making education more accessible to students across India. - ICICI Bank:

ICICI Bank provides comprehensive education loan solutions designed to support students at every stage of their academic journey. With competitive interest rates, flexible repayment options, and a wide network of branches across the country, ICICI Bank is a preferred choice for education financing. - Bank of Baroda (BOB):

Bank of Baroda offers education loans with attractive features, including competitive interest rates, no margin for loans up to a certain amount, and flexible repayment schedules. With a customer-centric approach and efficient loan processing, BOB strives to empower students to realize their educational aspirations. - Canara Bank:

Canara Bank’s education loan offerings are characterized by competitive interest rates, quick approval processes, and convenient repayment options. With a commitment to supporting students from diverse backgrounds, Canara Bank plays a crucial role in facilitating access to quality education in India. - Federal Bank:

Federal Bank provides customized education loan solutions tailored to meet the unique requirements of students and their families. With transparent terms, competitive interest rates, and personalized service, Federal Bank aims to ease the financial burden of education and foster academic excellence.

Choosing the right education loan provider is essential for ensuring a smooth and stress-free borrowing experience. The institutions listed above are among the top education loan providers in India, offering competitive rates, flexible repayment options, and excellent customer service.

By exploring your options and comparing the features offered by different providers, you can select the one that best aligns with your educational goals and financial needs.

Navigating Student Loans in India

Your Comprehensive Guide

Discover everything you need to know about student loans in India, from eligibility criteria to repayment options, in this informative guide.

Student loans are a vital lifeline for many aspiring students in India, providing the necessary financial support to pursue higher education dreams. However, navigating the intricacies of student loans can be overwhelming. In this comprehensive guide, we’ll break down everything you need to know about student loans in India, focusing on the key aspects that will help you make informed decisions.

Understanding the Basics: Before diving into the world of student loans, it’s essential to understand the basics. Student loans are financial aid specifically designed to assist students in covering the cost of their education. In India, these loans are offered by various financial institutions, including banks and government bodies.

Eligibility Criteria: To qualify for a student loan in India, you typically need to meet certain eligibility criteria. These may include factors such as nationality, age, academic record, and admission to a recognized educational institution. Additionally, some lenders may require a co-signer or collateral for larger loan amounts.

Loan Amount and Disbursement: The loan amount you can receive depends on various factors, including the course of study, the institution’s reputation, and the lender’s policies. Typically, loans cover tuition fees, exam fees, and other related expenses. The disbursement of funds usually occurs directly to the educational institution or in installments as per the course structure.

Interest Rates and Repayment Options: Interest rates for student loans in India vary among lenders and may be fixed or floating. Government-backed loans often offer lower interest rates compared to private lenders. Repayment options also differ, with some lenders offering moratorium periods during the study and grace periods post-graduation before repayment begins.

Documentation and Application Process: To apply for a student loan in India, you’ll need to submit various documents, including proof of identity, address, admission letter, academic records, and income proof of co-signer if applicable. The application process may differ slightly among lenders but generally involves filling out forms and providing necessary documentation.

Loan Repayment and Consolidation: After completing your education, it’s crucial to understand your repayment obligations. Timely repayment not only avoids penalties but also helps build a positive credit history. Additionally, if you have multiple student loans, consolidation options may be available to streamline repayment and potentially lower interest rates.

Seeking Financial Aid and Scholarships: While student loans are a popular option, exploring other forms of financial aid and scholarships can help lessen the burden of education expenses. Be proactive in researching and applying for scholarships, grants, and fellowships offered by government bodies, educational institutions, and private organizations.

Navigating student loans in India requires careful consideration and planning. By understanding the eligibility criteria, loan terms, and repayment options, you can make informed decisions that align with your educational and financial goals.

Remember to explore all available avenues for financial aid and seek guidance from financial advisors if needed. With the right approach, you can pursue your educational aspirations without undue financial stress.

Unlocking Educational Opportunities:

A Guide to Government of India Education Loans

Learn about the educational loan schemes offered by the Government of India to empower students in pursuing their academic aspirations. Discover eligibility criteria, benefits, and application procedures in this informative blog post.

In today’s rapidly evolving world, access to quality education is paramount for personal and professional growth. Recognizing this, the Government of India has introduced various initiatives to support students in their educational pursuits, including comprehensive education loan schemes.

In this blog post, we’ll delve into the details of education loans offered by the Government of India, empowering you to make informed decisions about financing your education.

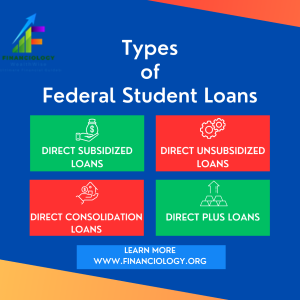

Understanding Government Education Loans:

Government education loans are financial assistance programs designed to help students cover the cost of their education. These loans are typically offered at favorable terms, including lower interest rates and flexible repayment options, to ensure accessibility for all aspiring learners.

Eligibility Criteria: To qualify for an education loan under the Government of India schemes, applicants must meet certain eligibility criteria. These criteria may include factors such as nationality, age, academic record, admission to recognized institutions, and family income levels. Additionally, some schemes may have specific requirements based on the course of study and institution.

Benefits of Government Education Loans:

One of the primary advantages of opting for a government education loan is the favorable terms and conditions it offers. Government schemes often provide lower interest rates compared to private lenders, making education more affordable for students from diverse socio-economic backgrounds.

Moreover, these loans may offer moratorium periods during the study and grace periods post-graduation before repayment begins, easing the financial burden on students.

Education Loan Application Process: Applying for a government education loan typically involves a straightforward process. Students need to fill out the prescribed application forms and submit necessary documents, including proof of identity, address, admission letter, academic records, and income certificates. Some schemes may require a co-signer or collateral for larger loan amounts.

Recent blogs:

- A Comprehensive Guide to Student Loan Calculators

- Unveiling Nelnet Bank: A Comprehensive Review

- A Review of SoFi Student Loan Refinancing

- Best Mortgage Rates

- Home Equity Loan

Student Loan Repayment and Subsidies:

Government education loans usually come with flexible repayment options to accommodate the financial circumstances of borrowers. Repayment typically begins after the completion of the course, giving students ample time to establish themselves in their careers. Additionally, certain schemes may offer interest subsidies for economically disadvantaged students, further reducing the overall cost of education.

Seeking Guidance and Support: Navigating the complexities of education loans can be daunting, especially for first-time applicants. Fortunately, several resources are available to provide guidance and support throughout the loan application process. Students can seek assistance from educational institutions, banks, and government authorities to clarify doubts and address concerns regarding education loans.

Conclusion:

In conclusion: Education is the cornerstone of individual growth and societal progress. With the Government of India’s education loan schemes, students can confidently access the financial support they need to pursue their academic aspirations.

By understanding the eligibility criteria, benefits, and application procedures outlined in this guide, you can embark on your educational journey knowing that financial assistance is within reach.