Discover The Best Student Loans for Education

7 min read

Unlocking Financial Freedom:

The Best Student Loans for Education

Discover the ultimate guide to navigating the maze of student loans for education. Find out which options offer the best rates, terms, and benefits to empower your educational journey without breaking the bank.

In today’s ever-evolving landscape of higher education, pursuing knowledge often comes hand-in-hand with financial challenges. With tuition fees soaring and living expenses rising, finding the right student loan is crucial for securing your educational future.

Fortunately, the realm of financial services offers many options tailored to meet the diverse needs of students. In this comprehensive guide, we delve into the realm of student loans, uncovering the best options available to finance your education without sacrificing your financial well-being.

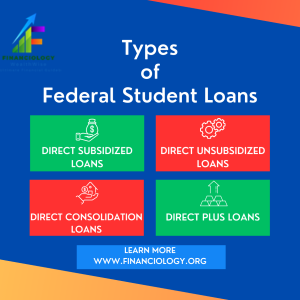

Federal Student Loans:

One of the primary avenues for financing education is through federal student loans. These loans, offered by the U.S. Department of Education, come with fixed interest rates and flexible repayment options. Stafford Loans, both subsidized and unsubsidized, are popular choices among students, providing competitive rates and borrower-friendly terms. Additionally, PLUS loans are available for graduate students and parents of dependent undergraduates, offering further financial assistance.

Private Student Loans:

While federal loans often serve as the cornerstone of student financing, private student loans can supplement these funds or serve as standalone options for those who do not qualify for federal aid or require additional assistance. Private lenders, such as banks, credit unions, and online financial institutions, offer a diverse range of loan products tailored to meet individual needs. These loans may come with variable interest rates, credit checks, and cosigner requirements, but they can provide flexibility and customization options that cater to specific educational expenses.

Considerations When Choosing Student Loans:

When evaluating the best student loans for education, several factors warrant consideration to ensure you make an informed decision aligned with your financial goals:

- Interest Rates: Compare the interest rates offered by different lenders to identify the most competitive option.

- Repayment Terms: Assess the repayment terms, including grace periods, deferment options, and loan forgiveness programs, to determine which loan aligns with your financial circumstances.

- fees: Be mindful of any origination fees, application fees, or prepayment penalties associated with the loan, as these can impact the overall cost of borrowing.

- Borrower Protections: Explore borrower protections, such as income-driven repayment plans and loan consolidation options, to safeguard against financial hardship.

Navigating the complex landscape of student loans requires careful consideration and informed decision-making. By leveraging the resources and expertise of financial service providers, you can unlock the doors to educational opportunities while maintaining financial stability.

Whether you opt for federal loans, private loans, or a combination of both, prioritizing affordability, flexibility, and borrower protections is essential for achieving your academic aspirations without undue financial burden.

Empower Your Educational Journey:

A Review of Discover Student Loans for Education

Dive into this comprehensive review of Discover Student Loans for Education and uncover how they can help finance your academic pursuits. Learn about interest rates, repayment options, and borrower benefits to make an informed decision for your educational future.

In the realm of student financing, Discover student loans emerge as a compelling option for individuals seeking to fund their educational endeavors. With competitive interest rates, flexible repayment terms, and borrower-friendly features, Discover offers a range of loan products tailored to meet the diverse needs of students.

In this review, we explore the key aspects of Discover student loans, providing insights to help you navigate the complexities of educational financing with confidence.

Discover student loan Interest Rates:

Discover student loans boast competitive interest rates that make them an attractive choice for borrowers. Whether you’re pursuing undergraduate or graduate studies, fixed or variable interest rate options are available to suit your preferences and financial circumstances.

By locking in favorable rates, you can minimize the long-term cost of borrowing and maximize your financial stability throughout your academic journey.

Discover student loan Repayment Options:

One of the standout features of Discover student loans is the flexibility they offer in repayment. Borrowers can choose from a variety of repayment terms, ranging from standard plans to extended or graduated options, allowing for personalized repayment schedules that align with individual financial goals.

Additionally, Discover provides access to deferment and forbearance programs, providing relief during periods of financial hardship or enrollment in further education.

Discover Student Loans Borrower Benefits:

Discover goes above and beyond to support borrowers throughout their educational endeavors, offering a range of benefits designed to enhance the borrowing experience. From cash rewards for good grades to interest rate reductions for enrolling in automatic payments, Discover incentivizes academic achievement and responsible financial behavior.

Furthermore, borrowers can access valuable resources and tools, including financial literacy resources and personalized loan counseling, to empower informed decision-making and promote financial wellness.

Discover student loans stand out as a reputable and reliable option for financing higher education. With competitive interest rates, flexible repayment options, and borrower-centric benefits, Discover empowers students to pursue their academic goals without undue financial burden.

Whether you’re seeking undergraduate or graduate funding, Discover offers the resources and support you need to embark on your educational journey with confidence and peace of mind.

Finding the Lowest Student Loan Rates for Education

Navigating the Waters: Dive into our comprehensive guide to discover how to secure the lowest student loan rates for financing your education. Learn about federal and private loan options, factors affecting interest rates, and tips for minimizing borrowing costs.

When it comes to financing your education, finding the lowest student loan rates can significantly impact your financial well-being in the long run. Whether you’re pursuing undergraduate or graduate studies, understanding the intricacies of student loans and interest rates is essential for making informed decisions about your financial future.

In this guide, we’ll explore strategies for securing the most competitive rates and minimizing the cost of borrowing to ensure a smooth and affordable educational journey.

Federal Student Loans:

Federal student loans are often the first stop for students seeking financing due to their favorable terms and borrower protections. These loans, offered by the U.S. Department of Education, come with fixed interest rates set by Congress, making them predictable and stable options for borrowers.

Stafford Loans, both subsidized and unsubsidized, offer competitive rates for undergraduate and graduate students, while PLUS loans provide additional funding for graduate students and parents of dependent undergraduates.

By completing the Free Application for Federal Student Aid (FAFSA), students can access federal loans and benefit from borrower-friendly features such as income-driven repayment plans and student loan forgiveness programs.

Private Student Loans:

In addition to federal loans, private student loans offer an alternative option for financing education, particularly for those who have exhausted federal aid or require additional funding. Private lenders, including banks, credit unions, and online financial institutions, offer a variety of loan products with varying interest rates and terms.

While private loans may offer competitive rates for well-qualified borrowers, they often require a credit check and may come with variable interest rates that can fluctuate over time. However, borrowers with excellent credit may be able to secure lower rates than those offered by federal loans, potentially saving money over the life of the loan.

Factors Affecting Interest Rates:

Several factors influence the interest rates offered on student loans, including:

- Credit History: For private loans, your credit history plays a significant role in determining the interest rate you qualify for. A higher credit score typically translates to lower rates, while a limited credit history or adverse credit events may result in higher rates or require a cosigner.

- Market Conditions: Variable interest rates on private loans are tied to market benchmarks such as the LIBOR or Prime Rate, which can fluctuate based on economic conditions and monetary policy.

- Loan Term: The length of the repayment term may affect the interest rate, with longer terms typically resulting in higher rates to compensate for the extended borrowing period.

Tips for Securing the Lowest Rates:

To maximize your chances of securing the lowest student loan rates, consider the following tips:

- Improve Your Credit: Take steps to improve your credit score by making timely payments, reducing debt, and addressing any errors on your credit report.

- Shop Around: Compare loan offers from multiple lenders to find the most competitive rates and terms. Consider factors such as interest rates, fees, repayment options, and borrower benefits when evaluating loan options.

- Consider a Cosigner: If you have a limited credit history or a less-than-ideal credit score, adding a cosigner with strong credit can increase your chances of qualifying for lower rates.

- Choose a Fixed Rate: While variable rates may initially be lower than fixed rates, opting for a fixed-rate loan can provide stability and protection against potential rate increases in the future.

In Conclusion:

Securing the lowest student loan rates is essential for minimizing the cost of borrowing and ensuring a financially sound educational experience. By exploring federal and private loan options, understanding the factors influencing interest rates, and implementing strategies to secure the best rates, you can embark on your educational journey with confidence and peace of mind.

Remember to weigh your options carefully, consider your financial circumstances, and make informed decisions that align with your long-term goals. With careful planning and diligence, you can navigate the waters of student loan financing and pave the way for a brighter future.

Helpful Links:

Discover Student Loan for Education: Click here

Discover Graduate Student Loans: Click here