Discover the top instant loan apps in 2024

7 min read

Exploring the Best Instant Loan Apps

Unlocking Financial Freedom:

Discover the top instant loan apps in the market that offer quick access to financial assistance, empowering you to navigate unexpected expenses with ease.

In today’s fast-paced world, financial emergencies can arise when least expected, putting individuals in need of quick and reliable solutions. Fortunately, the emergence of instant loan apps has revolutionized the way people access financial services, providing a convenient and efficient way to obtain funds on the go.

Among the plethora of options available, finding the best instant loan app tailored to your needs can be a game-changer in managing unforeseen expenses effectively.

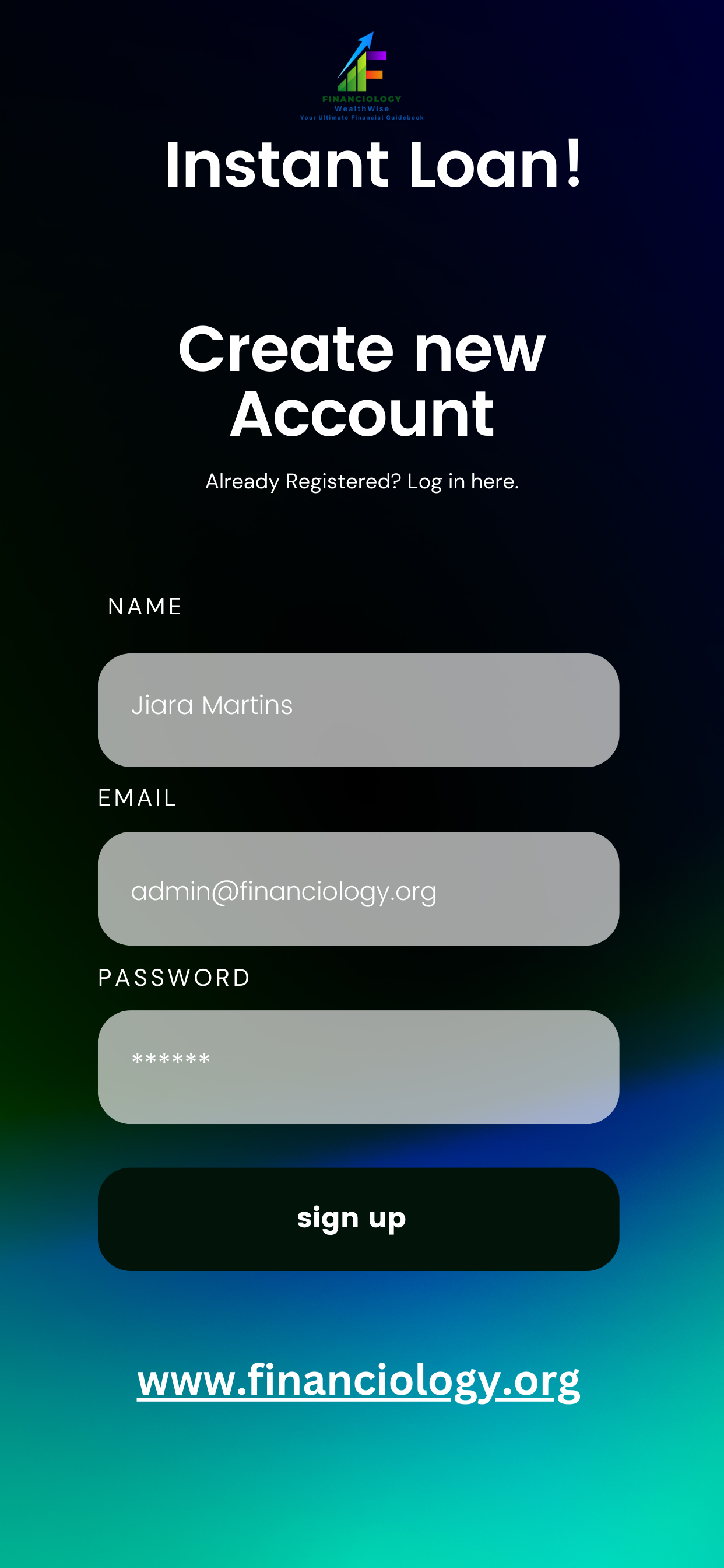

Instant Loan App Login

1. SpeedyCash:

SpeedyCash stands out as one of the leading instant loan apps renowned for its swift approval process and hassle-free interface. With just a few taps on your smartphone, you can apply for a loan and receive funds in your account within minutes, making it an ideal choice for urgent financial needs. Moreover, SpeedyCash offers flexible repayment options, ensuring convenience and peace of mind for borrowers.

2. CashNetUSA:

Another top contender in the realm of instant loan apps is CashNetUSA, esteemed for its transparent terms and efficient customer service. Whether you’re facing a medical emergency or need funds for home repairs, CashNetUSA provides a reliable solution with its seamless application process and competitive interest rates. Additionally, borrowers can benefit from personalized loan options tailored to their unique financial circumstances, enhancing accessibility and affordability.

3. Earnin:

For individuals seeking an alternative to traditional payday loans, Earnin emerges as a beacon of financial empowerment, offering innovative solutions to address cash flow challenges. Unlike conventional lenders, Earnin allows users to access a portion of their earned wages before payday, eliminating the need for high-interest loans and overdraft fees. By leveraging technology to bridge the gap between paychecks, Earnin enables users to regain control of their finances and build a more secure financial future.

4. Brigit:

Brigit distinguishes itself as a comprehensive financial wellness platform, empowering users to avoid overdrafts, track spending, and access instant cash advances when needed. With features such as automatic budgeting and real-time transaction alerts, Brigit goes beyond traditional loan apps to provide holistic financial management solutions.

By promoting financial literacy and offering proactive tools for financial stability, Brigit aims to redefine the way individuals manage their money and achieve their financial goals.

The best instant loan apps are pivotal in providing individuals with timely financial assistance and peace of mind during challenging times. Whether you’re facing an unexpected expense or need to bridge a temporary cash gap, these apps offer a convenient and reliable solution to meet your needs.

By leveraging technology and innovation, they empower users to take control of their finances and confidently navigate life’s uncertainties. Choose the best instant loan app that aligns with your requirements, and embark on a journey toward financial freedom today.

Streamline Your Finances: Exploring Advance Payday Apps

Discover the top advance payday apps that offer convenient solutions for managing cash flow gaps and unexpected expenses, providing users with quick access to funds when needed.

In today’s dynamic financial landscape, managing cash flow can be a challenge, especially when faced with unexpected expenses or delayed paychecks. Advanced payday apps have emerged as invaluable tools for individuals seeking to bridge temporary financial gaps and navigate unforeseen circumstances with ease.

By providing quick access to funds and flexible repayment options, these apps empower users to take control of their finances and achieve greater financial stability.

- Dave:

Dave stands out as a leading advanced payday app renowned for its user-friendly interface and innovative features. With Dave, users can access up to $100 in advances to cover expenses between paychecks, helping them avoid costly overdraft fees and late payment penalties.

Additionally, Dave offers budgeting tools and financial insights to help users track their spending and make informed financial decisions, making it a comprehensive solution for financial wellness.

- MoneyLion:

Another standout in the realm of advanced payday apps is MoneyLion, which offers a range of financial services tailored to meet users’ diverse needs. Through its Instacash feature, MoneyLion enables users to access up to $250 in advances with no credit check or interest charges, providing a convenient solution for short-term cash needs.

Moreover, MoneyLion offers rewards and cashback opportunities to incentivize responsible financial behavior, fostering a positive financial mindset among users.

- Brigit:

Brigit redefines the concept of advanced payday apps by offering a holistic financial wellness platform designed to help users avoid overdrafts, track spending, and access instant cash advances when needed. With Brigit, users can receive up to $250 in advances to cover unexpected expenses or bridge cash flow gaps between paychecks.

Additionally, Brigit’s budgeting tools and real-time transaction alerts empower users to make informed financial decisions and stay on top of their finances effortlessly.

- Earnin:

Earnin revolutionizes the traditional payday loan model by offering users access to their earned wages in advance, without the need for fees or interest charges. Through its innovative approach, Earnin empowers users to break free from the paycheck-to-paycheck cycle and gain greater control over their finances.

By leveraging technology to provide instant access to funds, Earnin promotes financial stability and resilience among its users, fostering a community-driven ethos of mutual support and empowerment.

In summary, advanced payday apps offer a convenient and accessible solution for individuals seeking to manage cash flow gaps and navigate financial challenges effectively. Whether you’re facing an unexpected expense or simply need to cover bills until your next paycheck, these apps provide a lifeline of support and empowerment.

Choose the advanced payday app that aligns with your financial goals and preferences, and embark on a journey towards greater financial well-being today.

Recent Posts:

- Streamline Your Finances with HDFC Netbanking

- A Review of Barclays Online Banking in 2024

- Looking for the best loan providers in the UK?

- Discover Financial Insights of Wells Fargo Online Banking

- Explore the Benefits of Capital One Online Banking

A Comprehensive Guide to Wells Fargo Mobile App Download, Installation, and Login

Mastering Your Finances: Learn how to download, install, and log in to the Wells Fargo Mobile App, a powerful tool for managing your finances on the go with ease and convenience.

In today’s digital age, managing your finances has never been easier, thanks to the Wells Fargo Mobile App. Whether you’re checking account balances, transferring funds, or paying bills, this app offers a seamless and secure way to stay on top of your financial transactions anytime, anywhere.

To unlock the full potential of the Wells Fargo Mobile App, follow these simple steps for download, installation, and log in.

- Downloading the App:

Begin by downloading the Wells Fargo Mobile App from the App Store for iOS devices or Google Play Store for Android devices. Simply search for “Wells Fargo Mobile” and look for the official app developed by Wells Fargo Bank, N.A. Once you’ve located the app, tap on the “Download” or “Install” button to initiate the download process. Depending on your internet connection speed, the download should only take a few moments.

- Installation Process:

Once the app has finished downloading, tap on the app icon to open it. Follow the on-screen prompts to complete the installation process. You may be required to grant certain permissions, such as access to your device’s camera for mobile check deposit functionality or location services for branch and ATM locator features. Review and accept the app’s terms and conditions to proceed with the installation.

- Logging In to the App:

After successfully installing the Wells Fargo Mobile App, it’s time to log in and access your account. If you’re an existing Wells Fargo customer, simply enter your username and password associated with your online banking account. If you’re a new user, you can enroll in online banking directly through the app by following the prompts to create a username and password.

For added security, you may be prompted to verify your identity using additional authentication methods, such as a one-time passcode sent to your registered mobile phone number or email address.

- Exploring App Features:

Once logged in, take some time to explore the various features and functionalities offered by the Wells Fargo Mobile App. From checking your account balances and transaction history to transferring funds between accounts and paying bills, the app provides a comprehensive suite of tools for managing your finances with ease. You can also set up alerts and notifications to stay informed about account activity and receive important updates from Wells Fargo.

- Security Measures:

Wells Fargo prioritizes the security of your financial information and employs robust security measures to safeguard your account. Be sure to enable biometric authentication, such as fingerprint or facial recognition, if available on your device, to add an extra layer of protection to your account.

Avoid sharing your login credentials with anyone and refrain from accessing the app on public or unsecured Wi-Fi networks to mitigate the risk of unauthorized access.

In conclusion, the Wells Fargo Mobile App offers a convenient and secure way to manage your finances on the go, empowering you to stay in control of your financial well-being wherever life takes you. By following these simple steps for download, installation, and login, you can harness the full potential of the app and unlock a world of financial possibilities at your fingertips.

Download the Wells Fargo Mobile App today and embark on a journey towards greater financial freedom and peace of mind.